If you have excess funds in your 529, you may be able to roll it into a Roth IRA. For better viewability, check out this pdf.

Changes to Roth Contributions: 529 Plan Rollovers

Starting January 1, 2024, a new provision of the SECURE 2.0 Act offers 529 plan owners a chance to roll over unused 529 assets into a Roth IRA, providing an important opportunity for those concerned about leftover educational funds. With the right rules in place, this provision aims to give families additional flexibility in utilizing their 529 funds, even after they’ve been earmarked for education.

Key Changes and Benefits

Before SECURE 2.0, if a 529 plan beneficiary didn’t need the funds for education, withdrawing them meant incurring taxes and a 10% penalty on earnings, making it a poor option for leftover balances. Now, with the changes, families can roll over unused funds to a Roth IRA, which can grow tax-free for retirement. However, there are still important limitations and guidelines to follow.

The new rollover feature gives families a way to maximize the utility of their 529 plans by converting unused funds to tax-free retirement savings in a Roth IRA. Before this update, 529 plan account owners or beneficiaries faced penalties and taxes if they withdrew funds for nonqualified expenses. However, starting in 2024, families can now avoid penalties and taxes by transferring up to $35,000 from a 529 plan into a Roth IRA.

Rollover Limitations and Requirements

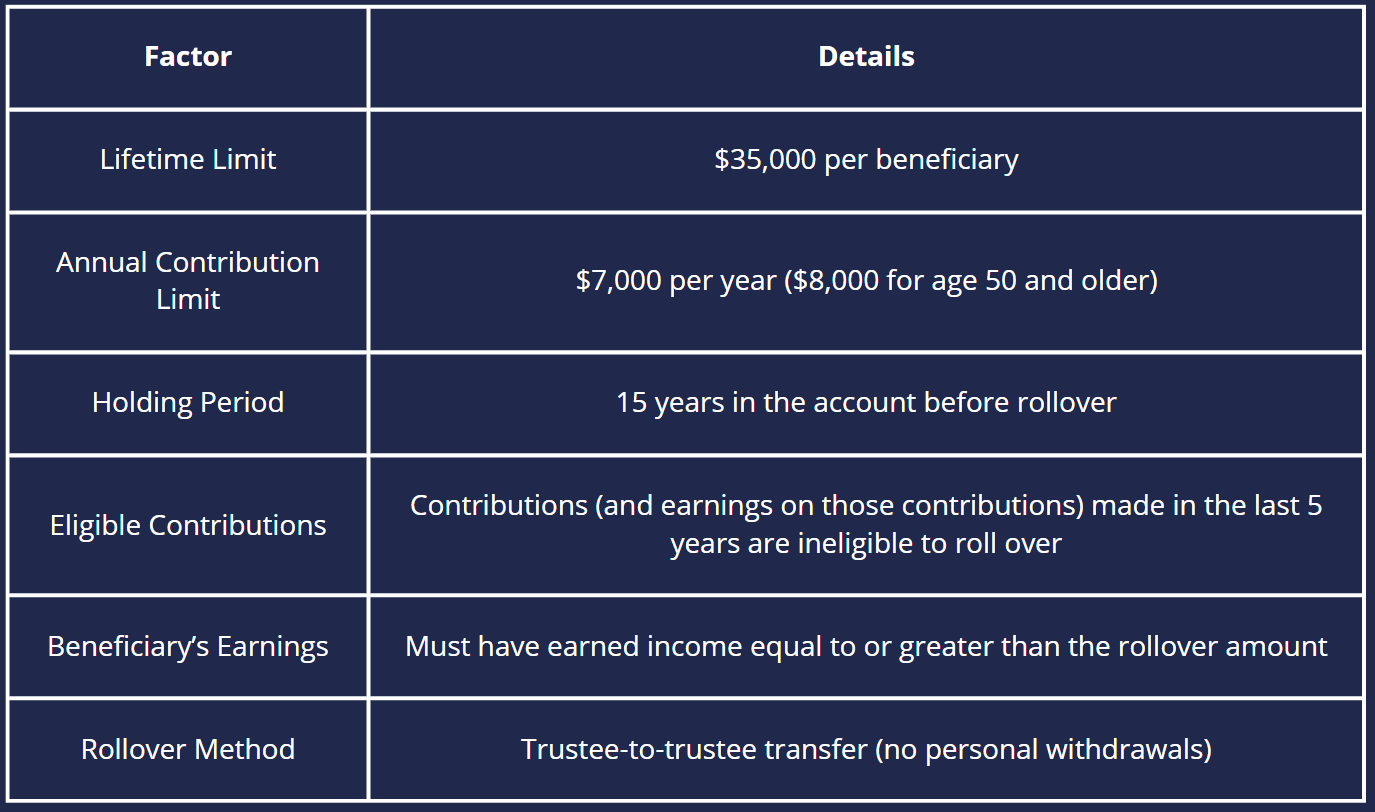

- Lifetime Limit: A $35,000 lifetime limit applies to each beneficiary’s 529 to Roth IRA rollover.

- Annual Contribution Limits: In 2025, the rollover amount cannot exceed the Roth IRA contribution limit of $7,000 for most people, or $8,000 for those aged 50 and above.

- Holding Periods: The 529 plan must have been maintained for 15 years before it can be rolled over.

- Earnings Requirements: The beneficiary must also have earned income at least equal to the amount rolled over.

The 529 to Roth IRA rollover provision allows families to transfer money that would otherwise be wasted into a valuable retirement account, but understanding these limits is crucial to ensuring eligibility and avoiding penalties.

State Tax Considerations

While the federal government allows the rollover to be tax- and penalty-free, some states might not recognize these transfers as a qualified expense. This could lead to state-level tax consequences, so it’s crucial to verify your state’s tax treatment of 529-to-Roth rollovers. Families can use resources like a 529 comparison tool to determine whether their state recognizes this new rollover opportunity.

How to Make the Rollover

To complete the rollover process, the beneficiary must open a Roth IRA account. The beneficiary listed on the 529 plan must also be the account owner of the Roth IRA. After this, families should initiate a trustee-to-trustee transfer from the 529 plan to the Roth IRA, ensuring that the transfer is handled directly between the financial institutions to avoid triggering taxes or penalties.

The ability to roll over 529 plan funds into a Roth IRA offers families greater flexibility in how they use their savings. It opens up a powerful strategy for people with leftover 529 funds, especially if the beneficiary decides not to pursue higher education or if the funds exceed the education needs. However, there are limitations, including the 15-year holding period, the annual contribution limit, and the $35,000 lifetime rollover limit. There is no income limit as is the case with a Roth IRA. For high-income earners who might otherwise be ineligible for Roth IRA contributions, this is a particularly valuable option.

Still, families should be careful in their planning, especially in understanding the nuances of the rules and state tax implications. Consulting a tax professional or financial planner is highly recommended to navigate this new opportunity. By following the proper steps, families can successfully make the most of their 529 plan funds, turning them into a tool for long-term retirement savings.

This information is for general informational purposes only and should not be considered investment advice or a specific tax or financial planning recommendation. It does not constitute an offer to provide financial services. Consult with qualified tax, legal, and financial professionals before implementing any estate planning strategies. Securities offered through Sanctuary Securities, Inc., Member FINRA, SIPC. Advisory services offered through Sanctuary Advisors, LLC., an SEC Registered Investment Advisor. Burnham Harbor Private Wealth is a DBA of Sanctuary Securities, Inc. and Sanctuary Advisors, LLC.