Check out this tax-efficient vehicle for those interested in philanthropy.

For better viewability, check out this pdf.

Donor-Advised Fund (DAF): A Flexible Approach to Philanthropy

A Donor-Advised Fund (DAF) allows individuals to make irrevocable charitable contributions to a sponsoring organization while maintaining the ability to recommend grants to other eligible charities. This structure provides donors with control over the timing and allocation of their charitable gifts while offering immediate tax advantages. DAFs are straightforward to set up, easy to manage, and do not require the formation of a custom legal entity.

A DAF is considered a direct donation to the sponsoring public charity for tax purposes. The sponsoring organization may be a community foundation, a large public charity such as a hospital or educational institution, or a public charity affiliated with a major financial institution. Donors or their designated representatives have the ability to recommend grants to eligible charities in amounts and at intervals of their choosing. Following the donor’s passing, successor advisors may continue making charitable grants.

Tax Benefits of DAFs

- Cash Contributions: Donors may deduct cash gifts up to 50% of their adjusted gross income.

- Securities and Appreciated Assets: Gifts of appreciated securities and other assets can be deducted up to 30% of adjusted gross income. Contributions of publicly traded stock and non-marketable property—such as closely held stock or real estate—are generally deductible at fair market value.

- Carryforward of Deductions: Unused deductions are carried forward up to five years.

- Avoidance of Capital Gains and Estate Taxes: Donors can bypass capital gains taxes on gifts of appreciated assets, and contributions to a DAF are removed from the donor’s estate, potentially lowering estate tax liability.

- Tax-Free Growth: Investments within a DAF grow tax-free, which may increase the available funds for future charitable grants.

Non-Tax Benefits of a DAF

- Flexibility: Donors have the ability to recommend grants to their preferred charities at any time and in any amount. This adaptability enables donors to align their charitable giving with personal or family interests over time.

- Encouraging Family Philanthropy: Donors can appoint family members or friends as account advisors, fostering philanthropic engagement across multiple generations.

- Privacy Protection: Donors have the option to contribute anonymously, ensuring their privacy while still supporting causes they value.

- Simplified Administration: A DAF provides a more efficient alternative to private foundations, offering lower administrative responsibilities and fewer reporting requirements.

Disadvantages of a DAF

- Irrevocable Donations: Once you contribute to a DAF, the gift is permanent—you can’t get the money back, even if your financial situation changes.

- Loss of Control: You can recommend grants, but the DAF sponsor has final say—they’re not legally required to follow your suggestions (though they usually do).

- Fees and Investment Limitations: Many DAFs charge management and administrative fees, which can reduce funds available for charity. You may have limited investment options and less control than with a private foundation or personal investment account.

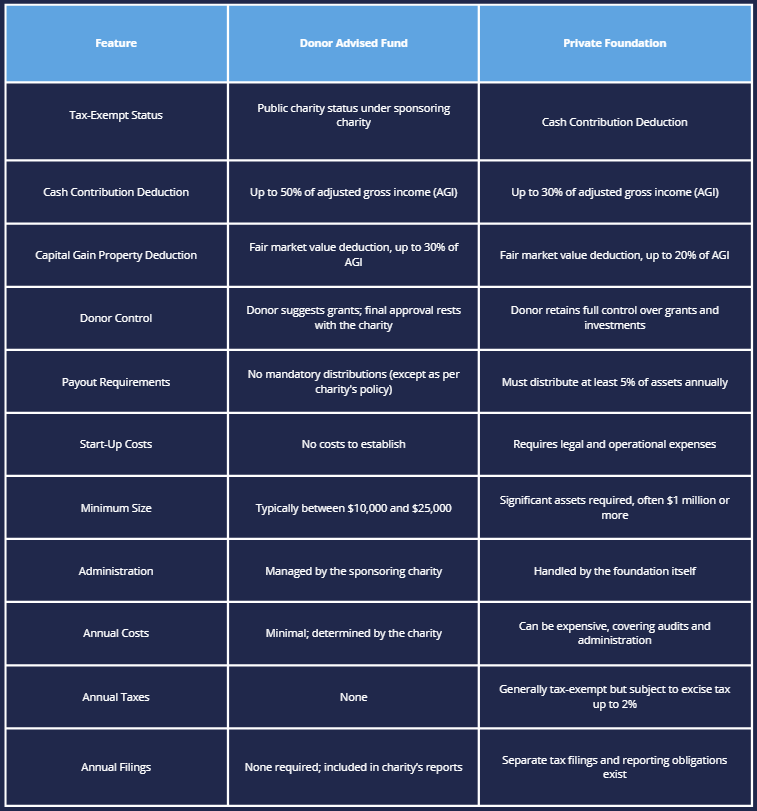

DAF or Private Foundation?

When evaluating a DAF, prospective donors should assess several factors, including whether the fund accepts non-traditional assets such as closely held stock or partnership interests, the number of individuals permitted to act as advisors during the donor’s lifetime and after their passing, any distribution requirements imposed by the sponsoring charity, the level of expert guidance provided by the sponsoring charity in recommending grants, and minimum contribution and addition thresholds.

A DAF provides a convenient, flexible, and tax-efficient method for individuals and families to support charitable initiatives over time. By offering immediate tax benefits and the opportunity to grow contributions tax-free, a DAF serves as a valuable tool for advancing philanthropic objectives while minimizing administrative complexities. For those seeking an alternative to private foundations with fewer regulatory requirements, a DAF presents an attractive solution.

Important Disclosure: The information in this document is intended for general informational purposes only and should not be considered investment advice or a recommendation of any specific tax, financial planning, or investment strategy. Additionally, this document does not constitute a solicitation or an offer to provide specific tax, estate planning, or financial planning services. Individuals should consult qualified tax, legal, and financial professionals for personalized advice before implementing any charitable giving strategies.

Securities offered through Sanctuary Securities, Inc., Member FINRA, SIPC. Advisory services offered through Sanctuary Advisors, LLC., an SEC Registered Investment Advisor. Burnham Harbor Private Wealth is a DBA of Sanctuary Securities, Inc. and Sanctuary Advisors, LLC.