Market review

US stocks sprouted to new record highs over the month, feeding on the stimulative nutrients of robust corporate earnings, moderating inflation pressures, and a more resilient-than-expected economy. The persistent strength of underlying economic data stoked hopes of an elusive soft landing but also emboldened Fed officials to begin to renege on some of their dovish December projections. Traders pruned their 2024 rate cuts bets from around six to now fewer than three, leading bond prices to wilt under the heat of a more hawkish outlook. Conversely, oil prices gushed higher, which Bloomberg attributed to simmering geopolitical tensions and OPEC supply cuts. Gold also glittered to record highs, potentially reflecting at least some brewing investor nervousness. Japan poetically stood out like a cherry blossom in full bloom, with local stocks finally eclipsing late-1980s all-time-highs amidst the backdrop of a strategic pivot away from its decade-long accommodative monetary policy. Emerging market (EM) stocks once again lagged, as China’s economic prospects remained overcast.

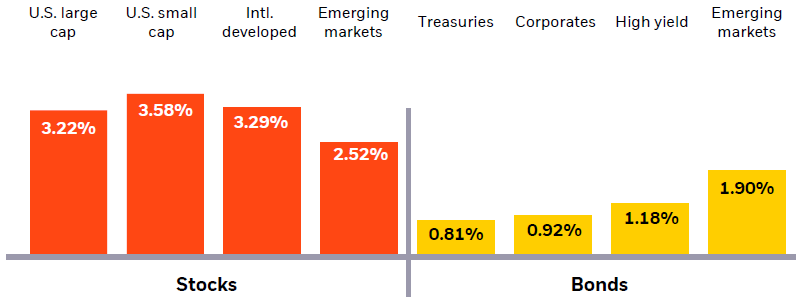

Market performance: March 2024

On… a ‘surprise’ pop in inflation spoiling the market’s mood:

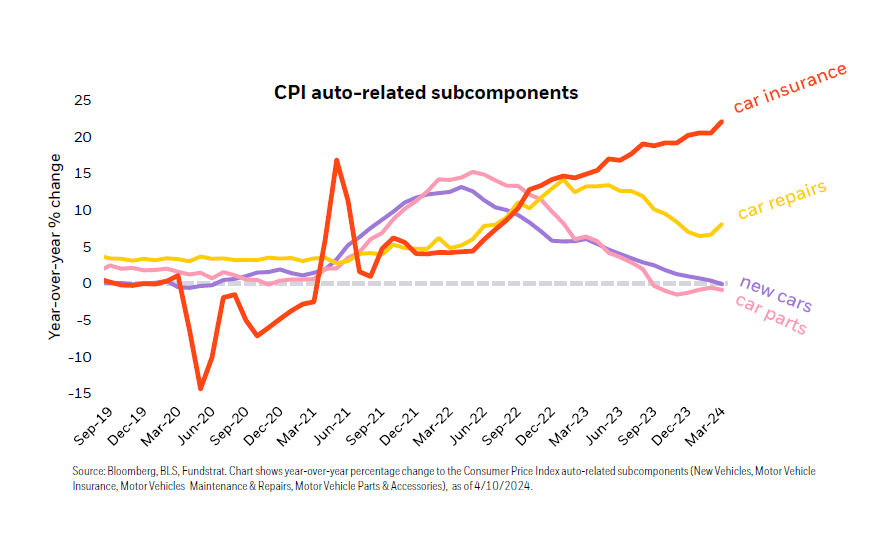

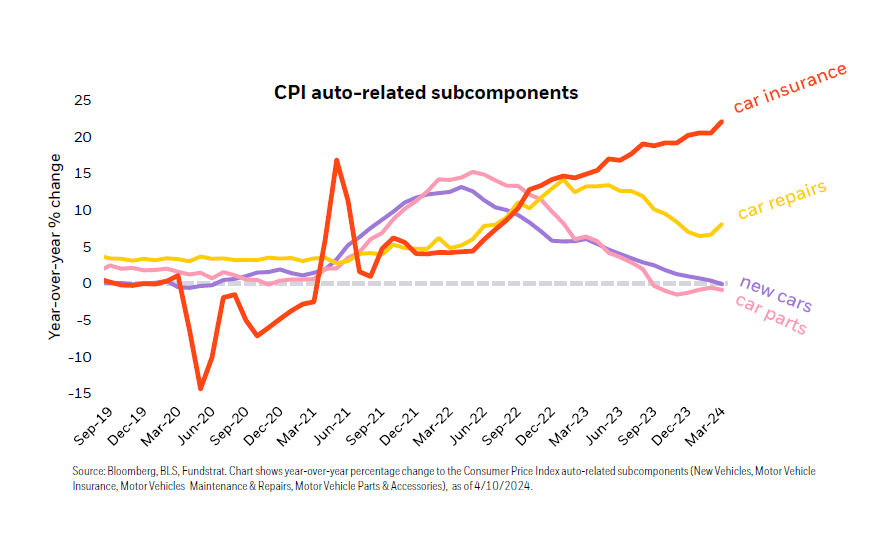

“This week’s CPI print came in above consensus economist expectations and has once again spooked stock and bond markets – but not us (at least not yet). As we’ve mentioned several times this year, our baseline expectations baked-in the strong possibility of at least a handful of inflation prints surprising to the upside over the early spring period as 3-years’ worth of inflationary impulses continue to work their way through the economy. The most troublesome remaining categories still holding on to elevated levels of inflation have been mostly contained to notoriously backward-looking components. This print is no exception. 35% of the CPI basket is now experiencing <3% inflation, with auto insurance accounting for nearly the entire upside surprise this month. This is a sub-component that is hardly controllable by raising or cutting rates. While markets remain nervous on the path and timing of rate cuts, the biggest victim of changes in the expected policy path is the long-willed “broadening” trade. Absent a re-rating in valuations from the macro side we will continue to focus our positioning on earnings. We expect our underweight positions in small cap stocks and bonds and overweight positions in tech and growth stocks to continue to outperform.” – Michael Gates, Managing Director, BlackRock

Asset class views

We are overweight U.S. stocks, leaning into quality large cap tech companies with the most resilient businesses, robust earnings growth, and upwards earnings revisions. We are modestly overweight emerging market government bonds, which have attractive relative yields and historically benefit during periods of easing monetary policy and falling inflation.

We are generally neutral on U.S. treasuries with exposure across the short-, belly, and long-end of the curve, and maintain complementary exposure to Treasury Inflation Protected Securities. We express a clear preference for quality-factor stocks and recalibrate our growth/value bets to lean more heavily into tech and growth-oriented stocks – but maintain tactical exposure to value-centric companies that may outperform in a higher-rate environment. We hold close to benchmark exposure to investment grade credit and mortgage-backed securities, increasing exposure to a freshly embedded active fixed income strategy capable of generating attractive yields and swiftly adjusting to changing market conditions.

Sluggish corporate earnings and more pronounced downside vulnerability to geopolitical turmoil and energy prices make international DM equities less attractive. We diversified our exposure with a currency-hedged position to protect against a stronger dollar and interest rate differentials remaining wide. We maintain a strategic tilt away from China and toward EM countries with more attractive earnings and long-term economic growth prospects (like India and Taiwan). We are marginally underweight US high yield bonds, with exposure to speculative grade issues primarily though actively managed income-focused strategies and added exposure to convertible bonds.