Burnham Market Insights – January 2024

January 31, 2024

Market review

A surprise dovish shift in Fed temperament led to a Bullcember to Remember and a dramatic unwind of the crowded ‘higher for longer’ trade. The Fed left rates unchanged at its December meeting but revealed a distinct sense of accomplishment in its fight against inflation, likely signaling the end of its intense two-year tightening campaign. Stocks and bonds rallied, with rates falling across the US treasury curve and futures markets pricing in the potential for five to six 0.25% rate cuts in 2024. Leadership within stocks began to meaningfully broaden beyond A.I.-fueled megacaps, with many year-to-date losers (like small caps) sharply outperforming. Regionally, international developed and emerging market stocks also rallied but lagged the US, as European central banks reinforced hawkish policy stances and a sluggish Chinese economy continued to absorb geopolitical, real estate, and policy uncertainties.

Market performance: December 2023

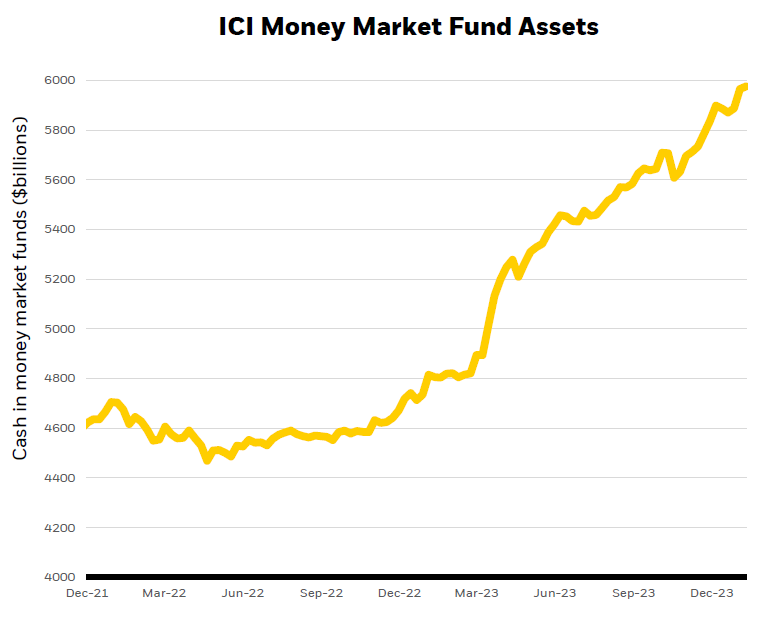

On… cash on the sidelines:

“Cash yields above 5% motivated investors to move money from volatile bonds and bank accounts to money market funds in records numbers in 2023. Money market fund assets (dry powder) now sit at $6 trillion dollars¹.” – Michael Gates, Managing Director, BlackRock

Asset class views

Source: BlackRock as of 12/31/2023, Views are subject to change

We move further overweight U.S. stocks, “buying the dip” on technology and large cap growth companies with strong, quality businesses and robust earnings. We are overweight U.S. treasuries with a barbell preference for short-(floating rate) and long-duration nominals for diversification purposes.

We maintain near benchmark-weight in emerging market bonds in fixed income-heavy models due to attractive yields and potential softening dollar strength. We compartmentalize our growth and value factor bets within regions as rate, inflation, and recession outlooks diverge, with continued broad preferences for growth and quality factor exposures. We express a slight preference for US high yield bonds, with a targeted tilt toward higher quality and undervalued issues.

We are underweight international developed market equities due to weakening corporate earnings signals and more pronounced downside vulnerability to potential rising energy prices and geopolitical turmoil. We remain cautious on emerging market stocks but increase exposure to countries with the most attractive growth prospects (like Taiwan) while also seeking to limit exposure to the litany of mounting headwinds in China. We hold close to benchmark exposure to investment grade credit and mortgage-backed securities, increasing exposure to credit risk in bond-heavy portfolios for potential upside.