Market review

US stocks staged an impressive revenge rebound after their brief slump in April, leaving the pessimistic ‘sell in May and go away’ crowd in tears. Comeback catalysts included another round of earnings surprises from the Mega-Cap tech juggernauts and a bouquet of ‘goldilocks’ economic reports that collectively hinted at an optimal mix of moderating growth. Emerging markets (EM) again underperformed Developed Markets, but an earnings-fueled rebound by AI and semiconductors stocks in Taiwan and South Korea gave EM stocks some much needed support. The timing and extent of potential interest rate moves in the US continued to cast a shadow over bonds, yet a modest reversal in recent hawkish Fed talk helped provide some relief as Chair Powell pushed back against the rumbling speculation of possible future rate hikes. Yields across fixed income inched lower, with longer duration and higher quality bonds outperforming the most.

Market performance: May 2024

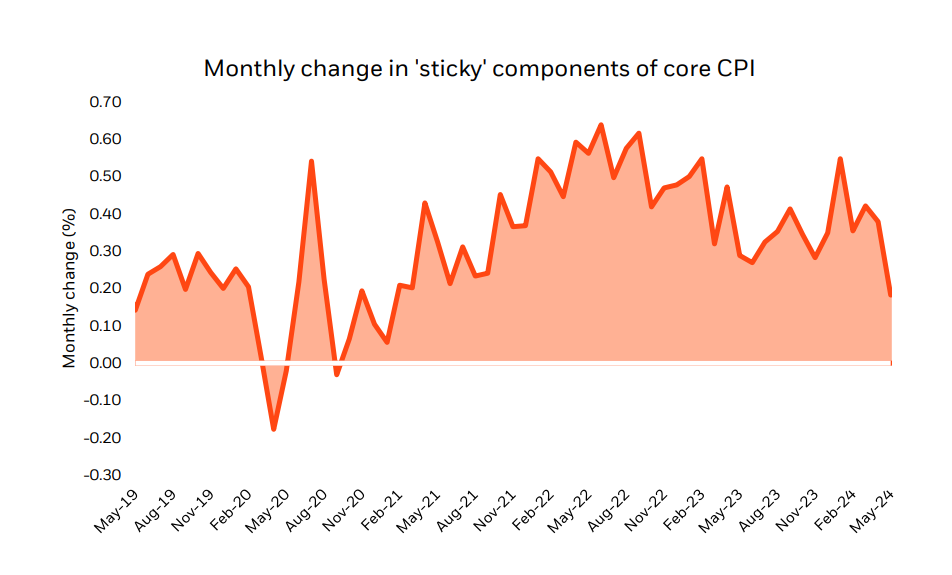

Inflation’s recent hot streak may have finally gone bust…

“May’s economic data dealt a brutal hand to the ‘sticky’ inflation narrative, with CPI, PPI, & import price readings all coming in below consensus market expectations. Even the so called stickiest components of core CPI came in noticeably weaker. Sure, Chair Powell’s preaching patience, saying one bad beat doesn’t mean the game’s over – but high inventories and a softening jobs market have started to put downward pressure on prices. Across consumer sectors, from bling to burgers, recent data suggests companies have become increasingly vulnerable to price cuts. Just look at autos – five straight months of falling prices.¹ We believe this broader unwind of inflation could pick up steam.” – Brett Wager, Market Strategist, BlackRock

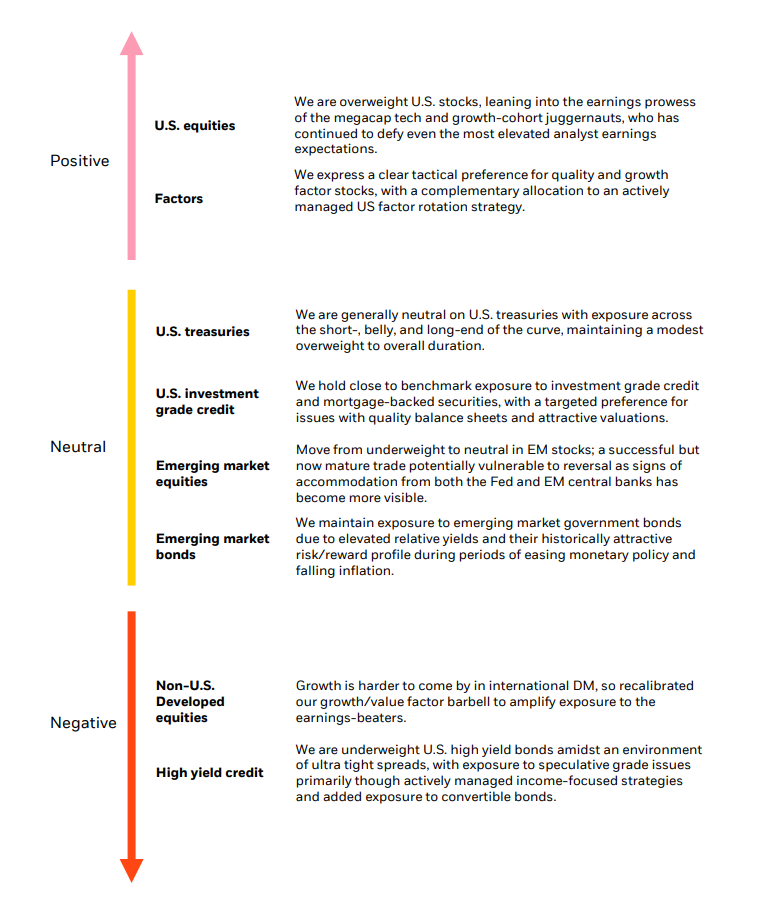

Asset class views