Fast moving markets rinse excess & test investor theses

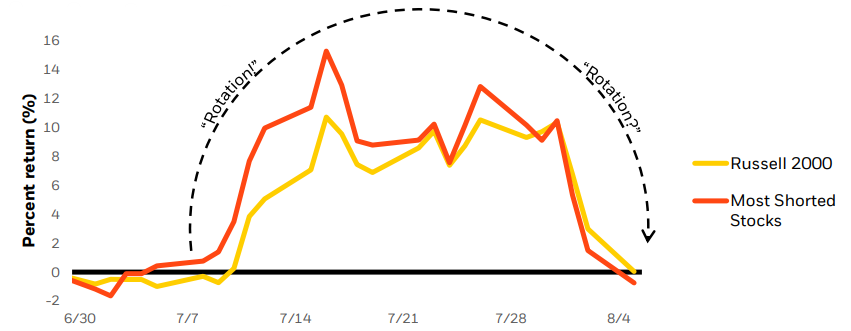

Market volatility has returned, and we are monitoring events closely. Jitters have been driven by a confluence of events (fears of a Fed policy mistake & renewed recession worries chief among them) and exacerbated by the interconnectedness of global capital markets. A primary culprit for the sloppiness of recent price action appears to be the collapse of the so-called ‘yen carry trade’ and the corresponding forced unwind of levered, speculative bets in heavily crowded positions. Markets are moving fast but our disciplined process helps prevent us from being led astray by short-term volatility. Small caps rallied over 15% in July – led by the junkiest names – only to give it all back in just a handful of trading days in August. We are earnings focused and the fundamentals of large US growth stocks remain solid absolutely and relative to alternatives. Despite mixed headlines, Q2 earnings results have been mostly encouraging thus far, and we note that AI capex spend is at full-throttle, slowed by capacity only. Credit spreads finally widened but remain tight and long-duration US treasuries are rallying, returning to their traditional role as a source of resilience amidst anxious markets. We note too that the US dollar is *not* rallying, suggesting something other than a “the world is truly ending” panic. This appears consistent with any ordinary ‘growth scare’ but non-recessionary-driven equity correction, particularly given the context of such a hot start to the year. As the earnings, inflation, and unemployment picture continues to evolve, we remain ready and willing to adjust the portfolio, as necessary.

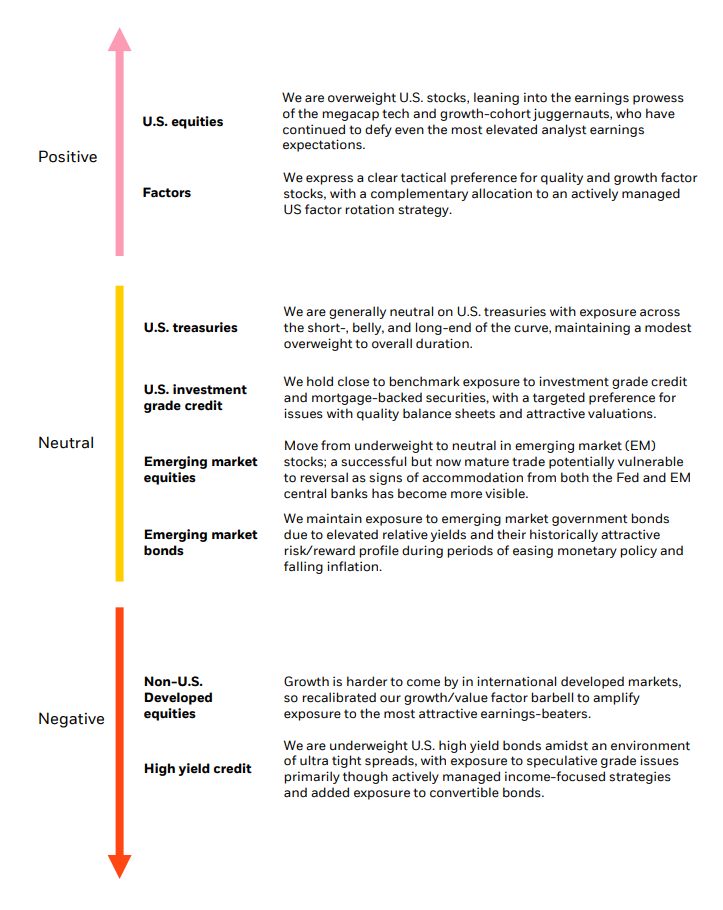

Asset class views

View are subject to change