Market review

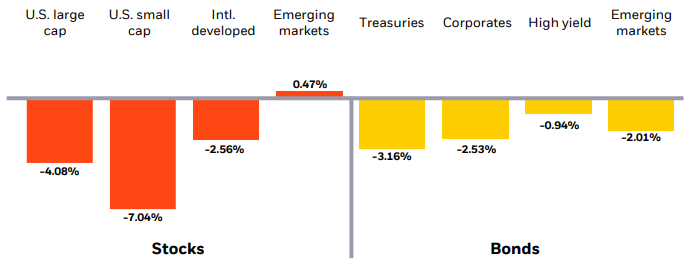

After a steady three-week pullback that eclipsed 5%, US stocks staged a heroic rebound toward the end of the month, according to Bloomberg. Nervous investors wiped their brow as strong Q1 earnings reports from Mega-Cap tech companies helped prop up the market despite an increasingly consensus opinion that interest rates could stay higher for longer. The hawkish lean in market sentiment propelled yields higher, with 10-year Treasuries closing the month above 4.6%. Small caps’ outsized sensitivity to interest rates caused them to underperform their large cap counterparts once again. Commodities and energy stocks outperformed but lost momentum as progress toward a cease-fire in the conflict in the Middle East made headlines. Japanese stocks gave up March’s gains and retraced lower but stabilized in conjunction with the yen on speculation of central bank intervention. Emerging markets (EM) eked out a modest gain, thanks to strength in commodities and growing investor appetite for beaten-down Chinese stocks.

Market performance: April 2024

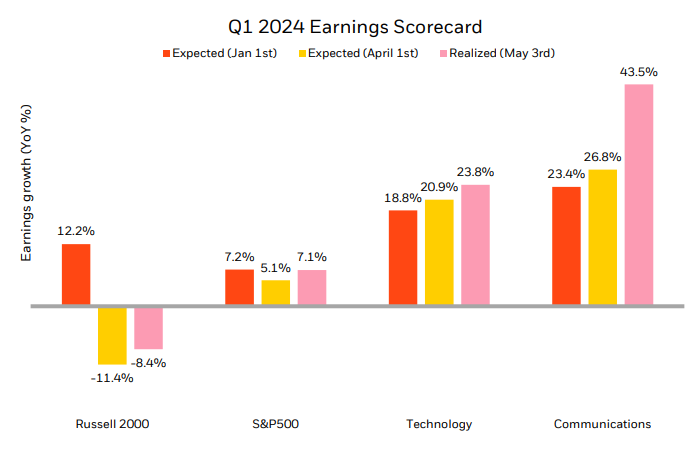

Checking in on… Earnings:

“Nearly 80% of S&P 500 companies have thus far beaten Q1 consensus EPS expectations¹, outpacing the post-pandemic average of 78%. Technology companies also continued to deliver, impressively surpassing ever-loftier expectations. Earnings growth for small cap companies on the other hand are trending slightly better than the -11.4% expected at the kickoff of earnings season, but well behind the positive growth that was expected at the beginning of the year.” – Brett Wager, Market Strategist

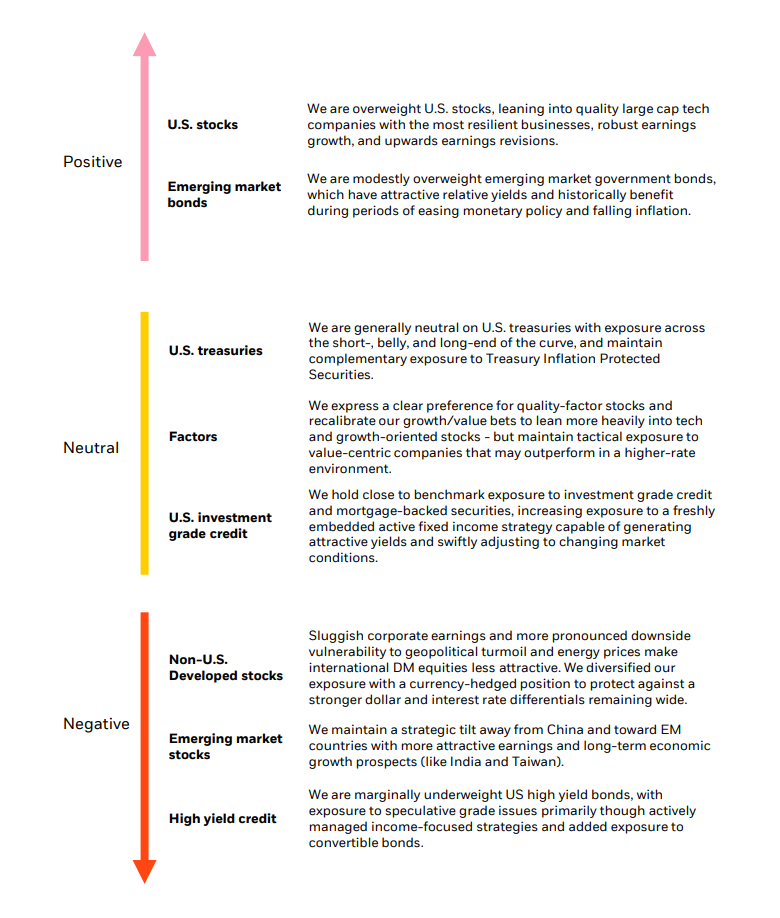

Asset class views